Chief Investment Officer Programme

Invalid liquid data

Invalid liquid data

Overview for the Chief Investment Officer Programme

The Chief Investment Officer Programme from London Business School Executive Education transforms investment executives into institutional leaders who can combine strategic foresight with governance excellence and sustainable investment policies. In the shifting landscape of fintech, artificial intelligence (AI), decentralised finance (DeFi), blockchain and digital assets, organisations want CIOs who can lead capital with clarity, resilience and purpose while driving innovation.

Through an integrated blend of online learning and immersive on-campus sessions, this programme prepares senior finance professionals like you to step into a CIO role that stands at the intersection of performance, governance and purpose. You will learn to create resilient and responsible investment strategies by exploring global macroeconomic dynamics; sustainability insights; emerging technologies, including AI and blockchain; and the full spectrum of public and private asset management. You will emerge from this programme as a strategic communicator and innovation steward ready to steer capital in a rapidly evolving world.

AI and emerging technologies

The investment landscape is being redefined by breakthroughs in AI, digital assets and decentralised systems. This programme equips you with the frameworks to evaluate, adopt and lead these innovations responsibly and strategically.

Understand how AI, ML and data science tools support forecasting, algorithmic decision-making and investment analysis.

Examine approaches to algorithmic trading and the role of AI-driven methods in investment strategy and risk management.

Evaluate opportunities and risks in DeFi, including tokenisation, initial coin offerings, security token offerings and related cybersecurity challenges, to understand its role in institutional investment strategy.

Examine the evolution of crypto assets, from Bitcoin and Ethereum to stablecoins and tokenised assets, and understand the emergence of central bank digital currencies.

Learning outcomes: Chief Investment Officer Programme

The Chief Investment Officer Programme will equip you to:

delve into the current economic landscape and key developments across asset classes: public equity, credit, private equity funds, real estate, commodities, derivatives and digital assets

master sophisticated techniques for building resilient and optimised portfolios across diverse asset classes

understand how to evaluate and select external managers across different asset classes

leverage AI, ML and data science techniques to enhance all facets of the investment process

integrate sustainability goals and environmental, social and governance (ESG) criteria in a multi-asset class portfolio

cultivate strategic leadership capabilities essential for a CIO.

Is the Chief Investment Officer Programme right for you?

The programme is ideal for:

professional asset and wealth managers aiming to deepen their expertise in multi-asset strategy, risk management and ESG integration while advancing from portfolio management to institutional leadership

private and family capital leaders, including principals, CIOs and investment heads at family offices and private investment professionals managing proprietary or multifamily wealth, looking to design institutional-grade investment frameworks and translate macroeconomic insights into long-term, resilient portfolio and investment strategies

sovereign and institutional investors and other senior finance professionals seeking to strengthen their asset allocation, institutional portfolio governance and sustainability capabilities, aligning investment innovation with regulatory, operational and risk management constraints.

Learning journey

Curriculum

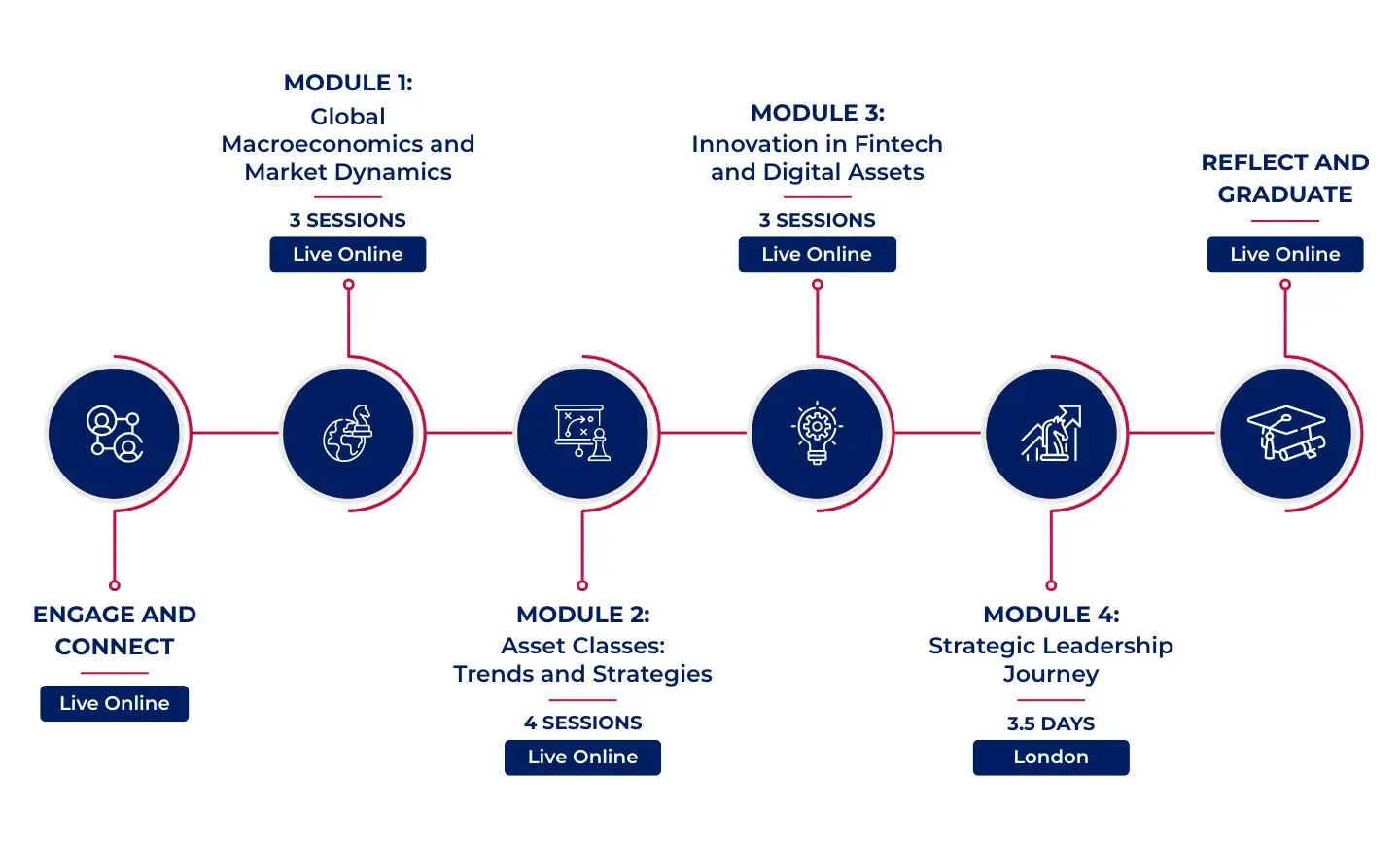

The CIO Programme curriculum is divided into two phases: Global Leadership Refined and LBS On-Campus Immersion. In Phase 1, you will explore global macroeconomic trends, different asset classes and innovation in fintech and digital assets. In Phase 2, you will engage in experiential learning with London Business School thought leaders and apply insights in action learning sets with industry peers.

Analyse how global economic trends, monetary and fiscal policies, and geopolitical shifts shape financial markets. The topics explored in this module are:

inflation

interest rates

currency movements

emerging market dynamics

asset allocation

commodity cycles

Throughout the module, LBS faculty will lead three live online sessions that deepen your understanding of global macroeconomics and market dynamics.

Session 1: Global Macroeconomic Environment

Deep dive into the fundamental forces shaping the global economy, including:

long-run growth and productivity trends

global inflation dynamics

demographic trends and labour markets

international economics and trade

Session 2: Macroeconomic Environment in Different Regions

Examine the economic conditions across major regions, including:

North America (namely, the United States)

Europe (namely, the United Kingdom and the European Union)

Asia (namely, the Middle East, India, China and Japan)

Africa

Central and South America

Oceania (namely, Australia)

Session 3: Economic Policy and Regulation

Gain a deeper understanding of:

monetary policy

fiscal policy

public debt

financial stability

regulatory frameworks

Discuss recent industry trends and portfolio management strategies in different asset classes. The topics explored in this module are:

public equities

credit

private equity

real estate and infrastructure

commodities and derivatives

In this module, faculty will deliver four live online sessions designed to provide you with a comprehensive view of different asset classes, trends and strategies.

Session 1: Public Equity

Focus on current developments in:

equity valuation methods and techniques

systematic investing

factor models

value investing

passive portfolios: benchmarking and tracking errors

Session 2: Private Equity

Gain a clear view of:

the private equity landscape

fund structures

fees and performance measurement

investment strategies

exit strategies

co-investments

Session 3: Credit

Discover the latest trends in:

credit instruments

sovereign debt market

corporate bond market

risk measurement across credit, interest rates and liquidity

fixed-income derivatives

private credit

Session 4: Real Estate/Commodities and Derivatives

Deepen your understanding of:

real estate asset classes

property ownership structures

real estate valuation

property income and operating expenses

debt structures and financing models

commodity sectors

market participants

exchanges and OTC markets

contracts and contract mechanics

Explore the disruptive technologies and evolving business models reshaping the financial services industry. The topics explored in this module are:

innovation and fintech

crypto assets

DeFi

This module includes three 60-minute faculty-led live online sessions on innovation, fintech and digital assets.

Session 1: Innovation and Fintech

Gain a comprehensive understanding of:

the fintech landscape

blockchain and distributed ledgers

cryptocurrencies

consensus mechanisms, including proof of work and proof of stake

Session 2: Crypto Assets

Explore the expanding crypto asset landscape, including:

Bitcoin, Ethereum and other major crypto assets

stablecoins

central bank digital currencies

Session 3: Decentralised Finance (DeFi)

Discover current developments in:

DeFi

the tokenisation of assets

initial coin offerings

security token offerings

cybersecurity challenges

Experience an immersive in-person journey that transforms insights into action. Grounded in market research and the lived challenges of senior leaders, this module fosters sharper strategic thinking, stronger leadership impact and richer peer collaboration.

Day 1: Strategic Foundations in Investment Management

Learn to build an optimal portfolio by combining detailed risk measurement with real-world constraints. Work through the trade-offs between expected return, portfolio and liquidity risk. Apply risk measurement tools, including covariance, factor exposures, value at risk, conditional value at risk and scenario analysis, to inform strategic vs tactical allocation decisions.

Day 2: Evaluating Performance and Leading with Purpose

Performance Evaluation and Manager Selection

Assess performance rigorously and improve manager selection decisions using risk-adjusted returns, benchmarks and structured due diligence criteria.

ESG and Sustainability

Deepen your understanding of ESG ratings, factors and risks. Explore ‘green efforts’ and ‘green investments’, and learn how to incorporate sustainability into investment policy and portfolio construction.

Day 3: Innovation and AI

AI and Data Science in Investment Strategy

Explore the fundaments of AI/ML in finance, forecasting, algorithmic trading and risk management. Discover the latest developments in AI, ML and data science in the context of asset allocation and investment strategies.

Leadership and Governance

Develop the strategic leadership and governance skills essential for leading high-performing investment functions. Deep-dive into stakeholder management, ethical considerations, leading teams and establishing effective governance structures.

Day 4: Reflection and Action

Reflect on your learning journey and translate insights into actions. Create a 90-day leadership action plan and share it with your peers. The day ends with a plenary session to consolidate learning and celebrate the programme journey.

On-campus immersion

This part of the module will take place on campus in London. It includes a three-and-a-half-day on-campus immersion experience that brings you together with peers from around the world to exchange international perspectives and explore cutting-edge topics through panel discussions, guest lectures and in-person faculty sessions.

Note: the programme content is subject to change.

Programme highlights

Comprehensive curriculum

Benefit from a cutting-edge curriculum anchored in macroeconomics, cross-asset strategy and behavioural finance.

High-touch experience

Experience action-based learning through live online sessions, case simulations, discussions with cohort peers and a group project.

Pathway to alumni benefits

Earn a pathway to select London Business School alumni benefits upon programme completion.

Expert guest speakers and leading practitioners

Leverage guest lectures by industry experts to gain practical insights into the latest global economic trends.

Experts in the field

Faculty Director | Professor of Finance

Professor Francisco Gomes's areas of expertise include capital markets, asset allocation, household finance and macroeconomics. He joined the London Business School in 2000 as...

Professor of Economics

Paolo Surico is a Fellow of the Centre for Economic Policy Research, a Research Associate at the London School of Economics Centre for Macroeconomics and a Research Consultant...

Professor of Accounting

Florin Vasvari is an expert on the use of accounting information in credit markets and private equity funds. His research investigates the pricing and the role of accounting i...

Professor of Finance

João Cocco is a Research Fellow of the Centre for Economic Policy Research, a Fellow of the Centre for Financial Studies and a founding member of the CEPR Network on Household...

Assistant Professor of Finance

Svetlana Bryzgalova’s research interests cover empirical asset pricing, financial econometrics and macrofinance. Before London Business School, she was an Assistant Professor ...

Senior Credit Risk Manager

Andrey Petrichtche is a seasoned credit risk and structured finance expert with a strong background in senior roles across global commodity trading firms and international ba...

Professor of Finance

Professor Narayan Naik’s research interests explore how financial technology is breaking the financial services value chain through more efficient provisioning of payments, de...

Associate Professor of Strategy and Entrepreneurship

Jessica Spungin has years of experience and expertise in the translation of strategy into action. As an Adjunct Professor at London Business School, she has taught the Strateg...

Visiting Professor of Finance

Magnus Dahlquist’s research interests lie in asset management, asset pricing and international finance. He has also taught courses on asset management, corporate finance, debt...

Associate Professor of Strategy and Entrepreneurship

Ioannis Ioannou is a leading strategy scholar whose research focuses on sustainability and corporate social responsibility (CSR). More specifically, he seeks to understand how...

Clinical Professor of Management Science and Operations

Kostis Christodoulou has been teaching courses on data analytics, decision and risk analysis and financial Modelling since 1998 to students and business executives at London B...

Professor of Economics

Richard Portes is Professor of Economics at London Business School and Founder and President of the Centre for Economic Policy Research. He has taught and advised extensively ...

Affiliate Faculty; External Member, Monetary Policy Committee, Bank of England

Megan Greene is an economist and an External Member of the Bank of England’s Monetary Policy Committee, where she has been reappointed for a further term. She is also a Senior...

Affiliate Lecturer of Organisational Behaviour

Dr Lisa Duke is an Affiliate Lecturer of Organisational Behaviour at London Business School, where she teaches across degree and executive education programmes. She has worked...

Pathway to alumni benefits

The Chief Investment Officer Programme can be your stepping stone to earning exclusive alumni benefits. Select an additional five-day in-person programme from London Business School’s extensive portfolio and complete both programmes within one year from the completion of the Chief Investment Officer Programme to join an elite international alumni network. On completion, you will:

Join the London Business School Executive Education alumni network to take your place in a 17,000-strong community spanning 150 countries

Benefit from lifelong learning through monthly newsletters, interactive webinars and exclusive events in your region

Join LBS Hub, our interactive alumni platform, to connect and network with some of the finest minds in the world of business

Join the Executive Education LinkedIn group for LBS updates.

Certificate

Upon successful completion of the programme, each participant will receive a verified digital certificate of achievement from London Business School Executive Education.

Programme calendar

The programme combines online learning with a three-and-a-half-day on-campus immersion at the London Business School campus, where you will engage with global peers and translate learning into action to deepen your expertise and accelerate leadership growth. Delivered across two phases, it includes faculty-led modules, live expert sessions, coaching and peer learning. You will conclude the programme with a live online session, during which you will create a 90-day leadership action plan and celebrate the programme's journey.

Date | Location | |

|---|---|---|

Engage and Connect | 29 June 2026 | Pre-work + Live online session |

Module 1: Global Macroeconomics and Market Dynamics | 15 July–22 July 2026 | Live online | Three sessions |

Module 2: Asset Classes: Trends and Strategies | 8 September–27 October 2026 | Live online | Four sessions |

Module 3: Innovation in Fintech and Digital Assets | 10 November–8 December 2026 | Live online | Three sessions |

Module 4: Strategic Leadership Journey | 18–21 January 2027 | 3.5 days | In-person in London |

Reflect and Graduate | 22 February 2027 | Live online session |

Note:

The programme schedule and dates are subject to change.

This certificate programme does not grant academic credit or a degree from London Business School.

Why the CIO Programme with London Business School Executive Education

Situated in one of the world’s most dynamic financial centres, London Business School has long shaped the thinking of executives who guide capital flows, influence global markets and lead complex organisations.

The Chief Investment Officer Programme reflects this heritage. It is designed and delivered by distinguished London Business School faculty, including finance scholars, economists and practitioners, whose work has shaped modern investment thinking — from behavioural finance and asset pricing to macroeconomics, governance and sustainable investing. Their expertise ensures that every concept is grounded in rigorous research and directly applicable to institutional decision-making.

London is where global finance meets global leadership — and LBS is where CIOs are shaped.

FAQs

The London Business School Chief Investment Officer Programme is an advanced investment leadership journey designed to equip the next generation of CIOs with the strategic, technological and governance capabilities required to navigate today’s rapidly evolving investment landscape. Blending online learning with an immersive London module, the programme builds mastery across global macro trends, investment strategies, multi-asset classes, AI, ML, fintech and digital assets. Graduates join LBS’s 17,000-strong Executive Education alumni network, benefitting from continued learning and global peer connections.

The Chief Investment Officer Programme from London Business School Executive Education is ideal for senior investment leaders seeking to elevate their strategic vision, analytical capabilities, innovation mindset and investment leadership skills as they advance towards or strengthen their role as CIOs.

This investment and wealth management programme is ideal for private and family capital leaders, wealth and asset managers and investors of institutional or sovereign wealth funds looking to build institutional-grade governance frameworks, deepen multi-asset management, integrate AI and ESG and enhance risk management strategies. Participants typically bring extensive leadership experience and aspire to drive resilient, responsible and future-ready investment strategies within their organisations.

The Chief Investment Officer Programme combines live online sessions with London Business School faculty and an immersive three-and-a-half-day on-campus experience in London. Across two phases, you will explore global markets, asset classes, AI and digital assets and then apply these insights through experiential learning and action-based leadership exercises.

The Chief Investment Officer Programme from London Business School Executive Education equips senior executives like you with deep expertise in global macroeconomics, cross-asset strategy, AI and fintech innovation, sustainability and institutional governance. You will blend theory with practice through live sessions, applied case work and a group project that challenges you to design resilient, innovative investment strategies.

Professionals typically become CIOs by gaining experience across asset classes, building strong portfolio construction skills and developing the ability to lead investment teams and stakeholders. A modern CIO must also understand global market dynamics, behavioural finance principles, emerging technologies, risk governance and sustainability.

London Business School’s CIO Programme supports this journey by providing exposure to global macro trends, advanced portfolio management techniques, AI and ML applications in institutional finance and real-world investment challenges. The programme’s integrated leadership development and a group project help you translate technical insights into strategic objectives, preparing you for executive-level investment decision-making.

Applicants of this chief investment officer course must submit online applications that include essays based on their professional journeys. Apply early to increase your chances of admission, as application fees change from round to round.

Emeritus collects all programme payments, provides learner enrolment and programme support and manages learning platform services.

For the programme refund and deferral policy, please click the link here.

Programme fees for Emeritus programmes with London Business School may not be paid for with (a) funds from the GI Bill, the Post-9/11 Educational Assistance Act of 2008 or similar types of military education funding benefits or (b) Title IV financial aid funds.

Connect with a Programme Adviser for a 1:1 session

Our programme advisers have helped senior executives across the world choose the right programmes for their career goals. Schedule a 1:1 session to get a deeper understanding of why the Chief Investment Officer Programme is the right fit for you.

Email: lbs_cio@emeritus.org

Phone: +44 132 580 8719 (UK) / +971 80 0088601098 (UAE) / +1 618 753 6066 (USA) / +52 55966 18983 (LATAM)

Flexible payment options available.

Starts On